Credit Suisse building in Zurich. Photo via Plaza Financiera.

Credit Suisse, a convicted corporate felon, was awarded its third leniency agreement from the DOJ since 2009. As in many settlements with big companies, the $547 million fine being imposed is large in absolute terms but amounts to merely 2% of the global bank's profits last year.

One argument defenders of corporate deferred prosecution and nonprosecution agreements make is that the agreements make it possible to reform corporate offenders into good corporate citizens without having to go through the messy business of prosecution.

But repeat offenders like Credit Suisse receiving multiple subsequent leniency agreements shows that any hope one might place in the reforming power of these agreements is profoundly misplaced.

Less than three and a half years ago, Trump's DOJ inked a three-year nonprosecution agreement with a Credit Suisse subsidiary over the bank's corrupt scheme of hiring friends and family of Chinese officials in exchange for business opportunities.

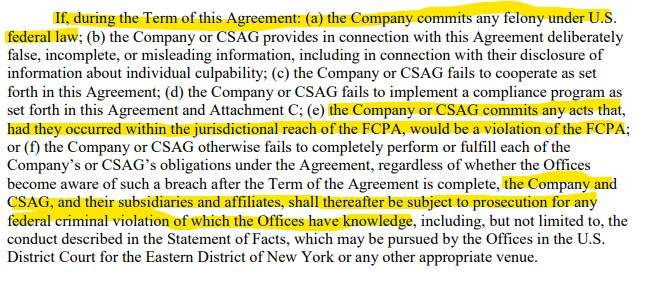

The way nonprosecution agreements are supposed to work is that if a corporate defendant violates the agreement by engaging in subsequent bad behavior, the agreement can be voided and the corporate defendant subject to prosecution. The language of Credit Suisse’s 2018 agreement seems fairly straightforward. Particularly interesting is that the language says Credit Suisse “shall thereafter be subject to prosecution for any criminal violation of which the Offices have knowledge” if, during the agreement’s term, Credit Suisse “commits any acts that, had they occurred within the jurisdictional reach of the FCPA, would be a violation of the FCPA.”

To be clear, last week’s resolution was over fraud, not Foreign Corrupt Practices Act violations. Now I’m not a lawyer, but I believe the alleged “kickback payments to [Credit Suisse’s U.K. subsidiary’s] bankers and the risk of bribes to Mozambican officials” referenced in the DOJ press release on the matter concede at least that Credit Suisse’s actions occurred within the FCPA’s jurisdictional reach. Basically, Credit Suisse managing directors were paid bribes in order to secure loans at more favorable interest rates, according to the BBC. (The Wall Street Journal’s reporting reveals the lurid details behind the $2 billion fraud conspiracy to which two bank directors and a former vice president ultimately pleaded guilty).

Assuming the leniency agreement Credit Suisse and the DOJ entered in 2018 expired at the end of its term, the new leniency agreement announced last week comes just five months later. (Credit Suisse did not respond to my attempt to confirm this fact.)

This earns Credit Suisse a place among the list of multinational financial corporations that the DOJ has had to put back in the leniency agreement penalty box less than one year after getting out.

Other banks on this list include HSBC, RBS, JPMorgan Chase, UBS and Wachovia (the details of their offenses and the time lapsed between their leniency agreements in Table 5 on page 40 of my 2019 Public Citizen report on the DOJ using leniency agreements to resolve criminal cases against corporate recidivists).

Earlier this month, senior DOJ official John Carlin warned an audience of corporate defense attorneys that businesses that fail to comply with the responsibilities these leniency agreements impose “should expect to see serious repercussions.”

I wonder which message the corporate defense attorneys heard more clearly — the message sent by Carlin’s “serious repercussions” warning or the message sent by the DOJ allowing Credit Suisse once again to avoid “serious repercussions”?

Big Business Blotter news roundup:

NEW RESEARCH

How Newspaper Closures Open the Door to Corporate Crime - Harvard Business School

The spikes in violations and penalties in paperless towns were economically significant, Heese says, representing a roughly $30,000 increase in penalties or 1 percent of a local facility’s sales, on average. Given that the average newspaper closure affects about 41 facilities, the closure of a local newspaper increases penalties by approximately $1.2 million over three years, the research shows. The results also suggest that when firms felt they could get away with something, they went big, Heese explains. The severity of the violations companies committed after newspapers vanished was more alarming than the increased volume, he says. And, because the data only captures wrongdoings that are detected, the real figures are likely higher, he notes.

New FTC Staff Report Outlines Impact of Fraud on Communities of Color - FTC

New research in a staff report from the Federal Trade Commission shows a number of key differences in the way that fraud and other consumer problems affect communities of color, from the types of problems reported to the methods used to pay scammers. The new report, “Serving Communities of Color,” highlights the FTC’s law enforcement and outreach work addressing consumer protection issues facing these communities in addition to the newly published research.

Companies closed nearly 14,000 arbitration cases in 2020, according to the American Association for Justice, the industry group for trial lawyers. That’s 17 percent more filings year over year, in a system with no path for appeal. And no company engaged in it more frequently than Family Dollar: The discount chain and its parent, Dollar Tree, arbitrated 1,135 cases in 2020 — nearly a third of all U.S. cases — compared with three the year before.

ENFORCEMENT POLICY

Wall Street, Companies May Have to Give Up More to Settle With SEC - WSJ

Only about 2% of 2,063 cases filed from 2014 through 2017 involved admissions, according to research by David Rosenfeld, a professor at the Northern Illinois University College of Law. Just 22 entities admitted fault in fraud cases, the most serious statutory violation the SEC can enforce, according to Mr. Rosenfeld’s paper, which was published in the Iowa Law Review.

“The deployment of mass worksite operations, sometimes resulting in the simultaneous arrest of hundreds of workers, was not focused on the most pernicious aspect of our country’s unauthorized employment challenge: exploitative employers,” Mayorkas wrote in a memo to several immigration agency officials.

SEC’s Peirce Criticizes Conditions Placed on Credit Suisse as Part of Waiver - WSJ

A Republican member of the Securities and Exchange Commission criticized conditions placed on Credit Suisse Group AG as part of a reprieve granted to the Swiss bank in connection with its $475 million settlement over a fundraising scandal in Mozambique.

Ericsson Accused of Breaching Bribery Settlement With Justice Department - WSJ

Ericsson said it would continue to cooperate with the Justice Department and would have the opportunity to respond to the department’s letter. A department spokesman declined to comment.

FACEBOOK

Federal Trade Commission Scrutinizing Facebook Disclosures - WSJ

Officials are looking into whether Facebook research documents indicate that it might have violated a 2019 settlement with the agency over privacy concerns, for which the company paid a record $5 billion penalty, one of the people said.

Mark Zuckerberg Will Be Added as a Defendant in Lawsuit Over Cambridge Analytica Scandal - Gizmodo

DC Attorney General Karl Racine’s office filed a suit in the Superior Court of the District of Columbia in December 2018 against Facebook over the Cambridge Analytica data-leak fiasco, alleging that the social media giant had misled consumers about its privacy policies. Racine announced on Tuesday that his investigation had determined Zuckerberg played a much bigger role in the incident than prosecutors were previously aware, according to the New York Times, and will be adding him to the suit. This would be one of the first times a regulator has tried to find Zuckerberg personally liable for the actions of his company.

Under the DOJ settlement, Facebook will pay a civil penalty of $4.75 million to the United States, pay up to $9.5 million to eligible victims of Facebook’s alleged discrimination, and train its employees on the anti-discrimination requirements of the INA. In addition, Facebook will be required to conduct more expansive advertising and recruitment for its job opportunities for all PERM positions, accept electronic resumes or applications from all U.S. workers who apply, and take other steps to ensure that its recruitment for PERM positions closely matches its standard recruitment practices. Today’s civil penalty and backpay fund represent the largest fine and monetary award that the Division ever has recovered in the 35-year history of the INA’s anti-discrimination provision.

AVOIDING ACCOUNTABILITY THROUGH BANKRUPTCY

J&J puts talc liabilities into bankruptcy - Reuters

Johnson & Johnson on Thursday put into bankruptcy tens of thousands of legal claims alleging its Baby Powder and other talc-based products caused cancer, offloading the potential liabilities into a newly created subsidiary.

Federal judge rejects a government bid to delay Purdue Pharma's bankruptcy settlement - NPR

In a surprise ruling late Wednesday a federal judge in New York allowed work to continue on implementation of a controversial bankruptcy plan for Purdue Pharma, the maker of Oxycontin. The U.S. Justice Department's bankruptcy watchdog agency had urged Judge Colleen McMahon of the U.S. District Court in Manhattan to put the brakes on the deal until it was reviewed on appeal.

FINANCE

If entered by the court, the settlement would require Trustmark to put $3.85 million into a loan subsidy program for impacted neighborhoods, increase its lending presence there, and implement proper fair lending procedures. The order would also impose a $5 million civil money penalty against the bank, and will credit the $4 million penalty collected by the OCC toward the satisfaction of this amount.

The Consumer Financial Protection Bureau (CFPB) today took action against the prison financial services company JPay for violating the Consumer Financial Protection Act (CFPA) by charging consumers fees to access their own money on prepaid debit cards that consumers were forced to use. JPay also violated the Electronic Fund Transfer Act (EFTA) when it required consumers to sign up for a JPay debit card as a condition of receiving government benefits – in particular, “gate money,” which is money provided under state law to help people meet their essential needs as they are released from incarceration. The consent order severely limits the fees JPay can charge on release cards going forward, allowing only inactivity fees after 90 days without card activity. The order also requires the company to pay $4 million for consumer redress and a $2 million civil money penalty.

CFTC Orders Tether and Bitfinex to Pay Fines Totaling $42.5 Million - CFTC

The Commodity Futures Trading Commission today issued an order simultaneously filing and settling charges against Tether Holdings Limited, Tether Limited, Tether Operations Limited, and Tether International Limited (d/b/a Tether) for making untrue or misleading statements and omissions of material fact in connection with the U.S. dollar tether token (USDT) stablecoin. The order requires Tether to pay a civil monetary penalty of $41 million and to cease and desist from any further violations of the Commodity Exchange Act (CEA) and CFTC regulations, as charged. The CFTC today also issued a separate order simultaneously filing and settling charges against iFinex Inc., BFXNA Inc., and BFXWW Inc. (d/b/a Bitfinex) in connection with their operation of the Bitfinex cryptocurrency trading platform. The order finds Bitfinex engaged in illegal, off-exchange retail commodity transactions in digital assets with U.S persons on the Bitfinex trading platform and operated as a futures commission merchant (FCM) without registering as required. It further finds that, through this same conduct, BFXNA Inc. violated Part VII. A. of the CFTC’s June 2, 2016 order. The order requires Bitfinex to pay a $1.5 million civil monetary penalty.

CORRUPTION

Goldman Sachs offers big retention bonuses to top executives, a year after docking their pay. - NYT

A year after Goldman Sachs clawed back or cut compensation from its top bosses over a corruption scandal, it’s paying them multimillion-dollar bonuses to stick around.

Honeywell Expects to Pay at Least $160 Million to Resolve Bribery Probes in U.S., Brazil - WSJ

Aerospace and industrial conglomerate Honeywell International Inc. said on Friday it has recorded a charge of $160 million to cover an expected loss related to bribery investigations by U.S. and Brazilian authorities. The Charlotte, N.C.-based company, which first disclosed the probes in 2019, is being investigated by the U.S. Justice Department, the U.S. Securities and Exchange Commission and Brazilian authorities related to its compliance with the U.S. Foreign Corrupt Practices Act and similar Brazilian laws.